» Tax / IRS Penalties

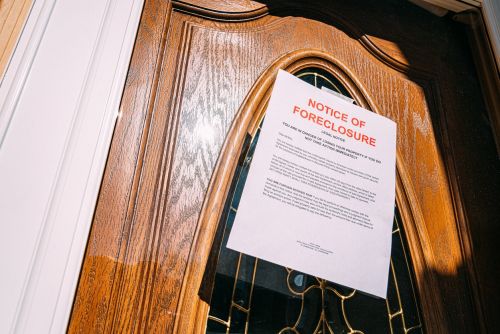

What Happens to Tax Liens After Bankruptcy and Foreclosure?

October 9th, 2025

If you have fallen behind on several of your debts, tax liens may only be one part of your financial difficulties. When unpaid debts pile up, you could end up facing tax liens, bankruptcy proceedings and foreclosures, sometimes all at once. But what…

Read More

If you have fallen behind on several of your debts, tax liens may only be one part of your financial difficulties. When unpaid debts pile up, you could end up facing tax liens, bankruptcy proceedings and foreclosures, sometimes all at once. But what…

Read More

Categories: Tax / IRS Penalties

How to Contest an IRS Notice of Tax Levy

June 13th, 2025

Receiving an IRS Notice of Tax Levy can be stressful, especially when it is inaccurate or you do not have the ability to pay your unpaid taxes. When that happens, you need to know how to contest an IRS notice of levy of unpaid tax liabilities, includ…

Read More

Receiving an IRS Notice of Tax Levy can be stressful, especially when it is inaccurate or you do not have the ability to pay your unpaid taxes. When that happens, you need to know how to contest an IRS notice of levy of unpaid tax liabilities, includ…

Read More

Categories: Tax / IRS Penalties

What Is a Tenant's Duty to Pay Rent to the IRS After a Tax Levy?

May 9th, 2025

Residential tenants often have little to no control over who they rent property from. But when a landlord runs into trouble with the IRS, it can be the tenant who is stuck paying. What is a tenant’s duty to pay rent to the IRS after a tax levy on a…

Read More

Residential tenants often have little to no control over who they rent property from. But when a landlord runs into trouble with the IRS, it can be the tenant who is stuck paying. What is a tenant’s duty to pay rent to the IRS after a tax levy on a…

Read More

Categories: Tax / IRS Penalties

How Long Does the IRS Have to Sue for FBAR Penalties?

March 11th, 2025

It can sometimes feel like an IRS audit or tax assessment can take forever, leaving taxpayers to wonder how long the IRS has to sue for FBAR penalties. A recent case coming out of the federal District Court in the Eastern District of New York shows t…

Read More

It can sometimes feel like an IRS audit or tax assessment can take forever, leaving taxpayers to wonder how long the IRS has to sue for FBAR penalties. A recent case coming out of the federal District Court in the Eastern District of New York shows t…

Read More

Tax Court Says IRS Appeals Officers Not Subject to Presidential Appointments Clause

February 10th, 2025

Does the President of the United States have the exclusive power to appoint or remove IRS Appeals Officers? In a January 29, 2025, opinion which seemed to almost anticipate the new administration’s actions in other areas of the government, the Tax…

Read More

Does the President of the United States have the exclusive power to appoint or remove IRS Appeals Officers? In a January 29, 2025, opinion which seemed to almost anticipate the new administration’s actions in other areas of the government, the Tax…

Read More

Categories: Tax / IRS Penalties

Tax Court Says IRS Can’t Assess Penalties on Foreign Informational Returns, Again

January 9th, 2025

The Tax Court has paved the way for the U.S. Supreme Court to determine whether the IRS has the authority to assess penalties on informational returns disclosing interests in foreign corporations. Rejecting the DC Circuit’s reversal of an earlier d…

Read More

The Tax Court has paved the way for the U.S. Supreme Court to determine whether the IRS has the authority to assess penalties on informational returns disclosing interests in foreign corporations. Rejecting the DC Circuit’s reversal of an earlier d…

Read More

Categories: Tax / IRS Penalties

Can an Employee’s Illness be a Reasonable Cause for a Delayed Business Tax Filing?

July 9th, 2024

Small businesses, and even large ones, depend on their top employees to do everything from interfacing with customers to filing company tax returns. When a key employee has a serious physical or mental illness at tax time, it can create problems for…

Read More

Small businesses, and even large ones, depend on their top employees to do everything from interfacing with customers to filing company tax returns. When a key employee has a serious physical or mental illness at tax time, it can create problems for…

Read More

Categories: Tax / IRS Penalties

D.C. Circuit Court Restores IRS’s Foreign Business Assessment Authority

June 6th, 2024

U.S. taxpayers with foreign business interests must disclose those interests to the IRS or face substantial penalties. But for the past year, the IRS’s foreign business assessment authority has been off-line. A 2023 Tax Court decision held that the…

Read More

U.S. taxpayers with foreign business interests must disclose those interests to the IRS or face substantial penalties. But for the past year, the IRS’s foreign business assessment authority has been off-line. A 2023 Tax Court decision held that the…

Read More

Categories: Tax / IRS Penalties

IRS Denied Trust Fund Recovery Penalties Against “Errand Boy” Employee

May 3rd, 2024

Imagine working as an employee for a company for two years and then having the IRS impose trust fund recovery penalties worth more than 10 times your annual salary. That’s exactly what happened in Powell v IRS, but when it came time for trial, the…

Read More

Imagine working as an employee for a company for two years and then having the IRS impose trust fund recovery penalties worth more than 10 times your annual salary. That’s exactly what happened in Powell v IRS, but when it came time for trial, the…

Read More

Categories: Tax / IRS Penalties

What Counts as Evidence in an Innocent Spouse Lawsuit?

April 9th, 2024

Can the IRS present new evidence in support of its administrative innocent spouse determinations? A recent Tax Court decision on a motion to strike provides new insight on what counts as evidence in an innocent spouse lawsuit. While the party present…

Read More

Can the IRS present new evidence in support of its administrative innocent spouse determinations? A recent Tax Court decision on a motion to strike provides new insight on what counts as evidence in an innocent spouse lawsuit. While the party present…

Read More

Categories: Tax / IRS Penalties